Around May each year I normally get a bit wary about the risks of a pullback in shares. It seems the old saying “sell in May and go away…” is permanently stuck in my mind. And of course shares have had a great run since their global growth scare “bear market” lows in February last year to their recent highs with global shares up 31% and Australian shares up 25%, and both saw good gains year to date to their recent highs of 7% and 5% respectively. Meanwhile, although there have been several calls this year that the so-called “Trump trade” – anticipation of his pro-business policies that supposedly drove the surge in shares since the US election – is over, the risks have intensified lately given the issues around Trump, the FBI and Russia with some fearing the Trump trade is now set to reverse. This note looks at the main issues.

Around May each year I normally get a bit wary about the risks of a pullback in shares. It seems the old saying “sell in May and go away…” is permanently stuck in my mind. And of course shares have had a great run since their global growth scare “bear market” lows in February last year to their recent highs with global shares up 31% and Australian shares up 25%, and both saw good gains year to date to their recent highs of 7% and 5% respectively. Meanwhile, although there have been several calls this year that the so-called “Trump trade” – anticipation of his pro-business policies that supposedly drove the surge in shares since the US election – is over, the risks have intensified lately given the issues around Trump, the FBI and Russia with some fearing the Trump trade is now set to reverse. This note looks at the main issues.

Trump trade or Trump bump

It’s now six months since Donald Trump was elected President of the US and four months since he was inaugurated. In many ways, it has gone better than feared: he has not withdrawn the US into isolationism, there has been no trade war with China, he has appeared more focussed on pro-business policies such as deregulation and tax reform than populist policies, and he appears far more supportive of the Federal Reserve under Janet Yellen than feared. But by the same token, many would see the events of the last two weeks – his firing of FBI director James Comey when it’s in the midst of looking into the links between Trump’s campaign and Russia, claims he may have attempted to influence the FBI to stop its investigation and reports he shared classified material with Russian officials all surrounded by a barrage of tweets and leaks – as confirming that his narcissism, short fuse, erratic nature and divisive approach render him unfit to be president. Comparisons to Nixon and talk of impeachment seem to be growing by the day.

In terms of investment markets, a common view seems to be that the “Trump trade” drove the surge in global share markets since the US election and that this will now reverse because of the political crises now surrounding Trump. However, this is too simplistic. First, the main reason for the rally in shares since last November has been the improvement in economic conditions and surging profits that has occurred globally and which had little to do with Trump. Second, unless things become terminal for Trump quickly the political crisis around him is more likely to speed up his pro-business reform agenda than slow or stop it. In this regard, the following are worth bearing in mind:

-

The process to remove a president by impeachment is initiated by the US House of Representatives and can be for whatever reason the majority of the House decides and conviction, removal from office, is determined by the Senate and requires a two-thirds majority.1

-

At present, Republicans control the House with a 21-seat majority and won’t vote for impeachment unless it’s clear that Trump committed a crime (and so far it isn’t obvious that he has) and/or support for him amongst Republican voters (currently over 80%) collapses.

-

However, Trump’s overall poll support is so low that if it does not improve the Democrats will gain control of the House at the November 2018 mid-term elections and they will likely vote to impeach him (they will almost certainly find something to base it on much like the Republican Congress found reason to impeach President Clinton) and then it’s a question of whether Trump can get enough support amongst Republican Senators to head off a two-thirds Senate vote to remove him from office (as Clinton did).

In short, Republicans only have a window out to November next year to get through their pro-business reforms. And the more the politics around Trump worsens, the more they need a win. So if anything, the current mess speeds up the urgency to get tax and other pro-business reforms done because after the mid-terms they probably won’t be able to. On this front, work on tax reform is continuing and Trump’s infrastructure plan looks likely to be announced soon.

The impact of past impeachments on the US share market is mixed and proves little. The unfolding of the Watergate scandal through 1973-74 occurred at the time of a near 50% fall in US shares but this was largely due to deep recession and double-digit inflation at the time. (President Nixon resigned before impeachment.) President Clinton’s impeachment had little share market impact but was in the midst of the tech bull market.

Correction risks and seasonality

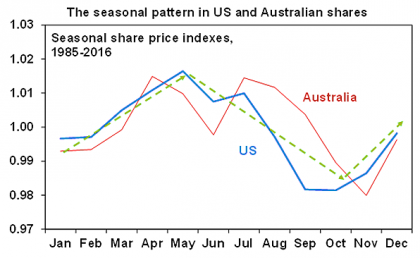

Share markets have had a great run and are arguably due a decent (5% or so) correction as a degree of investor complacency has set in. The latest scandals around Trump along with various other risks – North Korea and the ongoing march of Fed rate hikes – could be the trigger. (Corruption scandals in Brazil are a sideshow and are unlikely to have much impact beyond Brazil.) And it’s well known that the best time for shares is from November to May and the worst time is from May to November. This can be seen in the next chart, which shows the seasonal pattern in share markets since 1985.

Source: Bloomberg, AMP Capital

Most major share market falls have occurred in the May to October period (1929, 1987, worst of GFC, etc). Hence the old saying “sell in May and go away, come back on St Leger’s Day” still resonates. The seasonal pattern reflects tax loss selling by US mutual funds around the end of their tax year that sees them sell losing stocks around September in order to reduce capital gains tax bills, followed by having to buy shares back in November, the investment of year-end bonuses, New Year optimism and the absence of capital raising over Christmas and New Year all serving to drive shares higher from around October/November, which then peters out around May giving way to weakness that’s accentuated by tax loss selling in the September quarter. The only difference in Australia is that July tends to see a strong boost (as investors buy back after tax loss selling), but it otherwise follows the same pattern as the US.

Five reasons for optimism

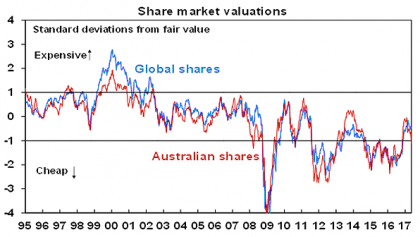

However, beyond current short-term risks and threats, there are several reasons for optimism. First, valuations for most share markets are not onerous. While price to earnings multiples for some markets are a bit above long-term averages, that is not unusual in an environment of low inflation. Valuation measures that allow for low bond yields show shares to no longer be as cheap as a year ago but they are still not expensive.

Source: Thomson Reuters, AMP Capital

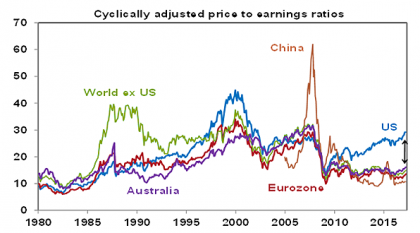

Second, while the US share market may be vulnerable on some measures, other share markets are not. If US shares are compared to a ten-year moving average of earnings (referred to as a Shiller or cyclically adjusted PE) then they are expensive and of course monetary conditions in the US are gradually tightening. However, the so-called Shiller PE remains cheap for most markets globally including Eurozone and Australian shares (next chart). Note also the last ten years include the GFC earnings slump and this will drop out next year, which will see the Shiller PE fall in most countries including the US.

Source: Global Financial Data, AMP Capital

Third, global monetary conditions remain easy and in the absence of broad-based excess (in growth, debt or inflation) look likely to remain so. The Fed is likely to hike rates two more times this year and start allowing its balance sheet to run down later this year but it’s still from a very easy base & other central banks are either on hold or easing. So a shift to tight money bringing an end to the economic cycle looks a fair way off.

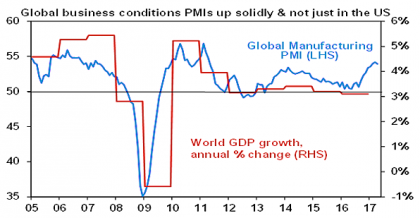

Fourth, global economic growth is looking healthier. Global business conditions indicators (or PMIs) are strong (next chart), the OECD’s leading economic indicators have turned up, jobs markets are tightening and for the first time in years the IMF has been revising up (not down) its estimates of global growth. US growth looks to be bouncing up again after a seasonal soft spot early this year, Chinese economic growth appears to be stabilising around 6.5% after an earlier upswing, Japanese growth looks to be good, the Eurozone looks strong and Australia is continuing to muddle along (not great but not bad – but nevertheless highlighting the ongoing case for Australian investors to have a decent global equity exposure).

Source: Bloomberg, AMP Capital

Fifth, profits are strong: US profits are up 14% year on year, Japanese profits are up 15%, Eurozone profits are up 24% and Australian profits look set to rise 20% this financial year.

Concluding comment

After strong gains over the last year and a strong start to the year until their recent highs, shares are vulnerable to a short-term correction as we go through seasonally weaker months. The political scandal around Trump, North Korea and Fed worries could all be a trigger. However, with most share markets offering reasonable value, global monetary conditions remaining easy and global growth and profits looking good, the trend in shares is likely to remain up.

If you would like to discuss anything in this article, please call us on 07 5443 8312.

Source: AMP Capital 23 May 2017

1The alternative to impeachment would be where Vice President Pence and Trump’s Cabinet remove him from office under the 25th Amendment of the Constitution which is aimed at dealing with a President who has become mentally incapable. While some may claim this should have happened from the start, it’s doubtful that Pence and Trump’s Cabinet see it that way!

About the Author