Introduction

What do the success of Donald Trump and Bernie Sanders in the US Presidential campaign, the close Brexit vote on Britain’s membership of the European Union and the Australian election have in common? They all signal some shift towards populism and support for more left wing policies in the electorate. If this trend flows through to actual policy making it’s another reason to expect constrained medium term investment returns.

The long term political cycle

Everything goes in cycles – both short and long. This is true of the weather, economies and financial markets. And it’s also true of politics, even beyond standard electoral cycles. After the economic disaster of the high tax, protectionism, growing state intervention and the welfare state of the late 1960s and 1970s became apparent in the stagflation of the 1970s/early 1980s popular support for economic rationalist right of centre policies grew in the 1980s. As a result Margaret Thatcher in the UK, Ronald Reagan in the US and Bob Hawke and Paul Keating in Australia ushered in a period of deregulation, freer trade, privatisation, lower marginal tax rates, tougher restrictions on access to welfare, measures to reign in budget deficits and other supply side economic reforms designed to boost productivity. This was helped along by the collapse of communism and the entrance of Russia, China, etc into the global trading system. There was even talk of “The End of History” to the extent that there seemed to be general global agreement that free market democracies were seen as the superior economic/political system. Economic rationalist policies remained the focus through the 1990s.

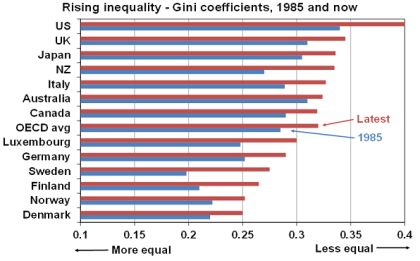

However, post the global financial crisis (GFC) it seems the pendulum is swinging to the left again. Not necessarily radically but it seems support for economic rationalist policies is fading. This appears to reflect a range of developments: the feeling that the GFC indicated financial de-regulation had gone too far; constrained and fragile economic growth in recent years; high household debt levels blocking off taking on more debt as a way to boost living standards; stagnant real incomes for median income households; and rising levels of inequality. The latter has not been as much of an issue in Australia (where the targeted tax and welfare system appears to have done its job). It is more so in the US and UK however, where the top 1% of income earners have seen their income share grow by around 10% and 5% respectively since the early 1980s, whereas lower and middle income earners have fared less well. The next chart shows the change in the Gini coefficient (a measure of income inequality) for major countries over the last 30 years.

Data is after taxes and welfare transfers. Source: OECD, AMP Capital

In this environment populist politicians have been able to easily tap into voter anger and argue the case for greater public sector involvement in the economy and a reversal of globalisation.

-

In the US, Donald Trump and Bernie Sanders (an avowed socialist) have done this very well. Trump was clearly to the left of other contenders in the Republican primaries and is advocating more government spending, appears to have no concerns about blowing out the budget deficit, is in favour of protectionism and curtailing immigration and has suggested that taxes on the rich and minimum wages will have to increase. Both Trump and Sanders are forcing centrist Democrat Hilary Clinton to the left. Maybe whoever ultimately wins the election will swing back to the centre but that may be difficult if voters have swung to the left.

-

In the UK the Labour Party has ditched the “New Labour” of Tony Blair and others and taken a left wing turn under Jeremy Corbyn. The success so far of the Leave campaign in the Brexit referendum appears to reflect a backlash against globalisation and immigration.

-

In Australia, it’s arguable that we are seeing the greatest left right divide in any election since those of the 1970s with the ALP being a long way from the economic rationalist policies of Hawke and Keating. Policies of higher taxes for high income earners (making the Budget Repair Levy permanent and winding back various tax concessions), significantly increased spending on health and education, a Royal Commission on banks, arguments against corporate tax cuts, a willingness to let the budget deficit expand further relative to the forward estimates, tax levies on foreign property purchases at a state level, etc, all suggest a populist focus reflecting a change in voter preferences (for at least that of the median voter). The policies of the Greens and minor parties who look likely to retain the balance of power in the Senate are of course further to the left. Gone from the election campaign is much debate about the need to undertake further economic reforms (including tax reform) if we wish to maintain decent sustainable growth in our living standards post the mining boom and ways to make government spending in areas like health and education as productive as possible. Even if the Coalition is re-elected there is a high risk that it remains constrained in implementing economic rationalist policies by the Senate.

I have focussed here on Anglo countries because it’s here that the swing to the right and economic rationalism was most pronounced in the 1980s and 90s and so the swing back may be more pronounced. Europe is arguably already more to the left anyway so it’s less of an issue there. One might add the retreat of Russia from the global economy at the margin in recent years and the stalling of the Doha round of trade negotiations are not good signs for globalisation.

What does it all mean for investors?

It’s hard to know how far the populist shift to the left will go in terms of actual economic policies. But the risk over time is that a more left leaning electorate will mean a tendency towards: faster growth in government spending; bigger than otherwise budget deficits; more regulation; higher effective top marginal tax rates; less globalisation; and tougher rules on immigration in some countries. Or it may just mean a stalling in economic reforms. The risk though is that it will act as another constraint on economic growth and eventually see a problematic pick-up in inflation if the supply side of the economy suffers.

It’s worth putting this in context. The secular bull market in global and Australian shares that saw them average strong double digit gains from 1982 to 2000 (or to 2007 in Australia’s case) was underpinned by several drivers. In particular:

-

High starting point investment yields. In 1982 bond yields were around 15%, short term interest rates were similar, dividend yields on shares were around 7-8% and the rental yield on housing was around 8%. High starting point yields helped set up high average returns over many years.

-

There was a shift from high to low inflation which enabled assets to be revalued/yields to fall all of which resulted in strong capital growth for investors.

-

Deregulation, cuts to high marginal tax rates and a shift towards small government all helped boost the supply side potential of economies. This and the next point is where the economic rationalist policies of the 1980s and 90s kicked in.

-

Globalisation – as reduced barriers to trade and the entrance of communist bloc countries to the global economy led to a surge in trade helping boost growth and keep inflation down.

-

Peace dividend – the collapse of communism and the ascendancy of the US as the main global power ushered in a period of (relative) geopolitical stability that allowed reduced defence spending which helped balance budgets.

-

A low profit share after the class warfare of the 1970s helped set up a good starting point for profit growth in the 1980s and 1990s as profit shares rose.

-

The starting point for household debt levels in the early 1980s was low relative to incomes but set to expand reflecting the increasing availability and affordability of debt which in turned helped fuel growth in consumer spending.

Now the environment is very different:

-

Starting point investment yields are ultra-low for most assets with bond yields averaging 1% or so, cash rates pushing near zero, gross residential property yields around 3% and global dividend yields around 2%. Some asset classes still have decent yields (eg, Australian shares and commercial property) but it’s a far more constrained starting point.

-

Deflation and then maybe rising inflation risk – the boost to investment returns from the shift from high to low inflation is well behind us. Deflation is far more negative than simple low inflation and if inflation ultimately does break out it could threaten some reversal of the return boost the shift to low inflation provided in the 1980s and 1990s.

-

Re-regulation, higher taxes and more government – this is already evident in financial re-regulation but if economic rationalism gives way more broadly to more left leaning policies it could slow productivity and hence the supply side of the economy which could ultimately add to inflation.

-

Backlash against globalisation – a reversal of free trade will slow growth.

-

Terror threat and the waning of US power – the peace dividend gave way to the terrorist threat last decade but more recently it seems that the relative decline of the US as a geopolitical power has given rise to tensions in the Middle East as Saudi Arabia, Iran and Russia vie to fill the gap left by the US and in the South China Sea as China seeks to flex its muscles. What is clear is that the favourable direction of change from the fall of the Berlin Wall in 1989 is over.

-

While less evident in Australia, the profit share is high in the US and vulnerable if economic policies take a leftist turn.

-

Household debt levels relative to incomes are now high with households post GFC much more reluctant to add to debt. This has in turn cut off a potential driver of growth.

Constrained medium term investment returns

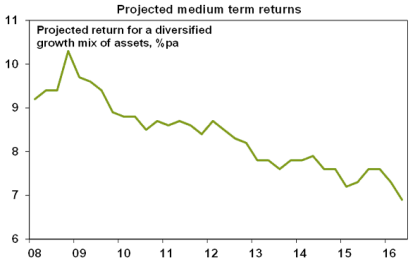

The key point is that the powerful tailwind from the economic rationalist policies (deregulation, smaller government and globalisation) is now behind us and is contributing along with a range of other factors to a much more constrained return environment for investors. Our medium term projections for the investment returns from a balanced mix of assets have been steadily declining in recent years and fell below 7% this month.

Source: AMP Capital

While this does not mean there won’t be individual years with high returns it does point to ongoing average returns being constrained compared to the past. Of course in a world of ultra-low inflation, a just below 7% nominal return is not disastrous.

But what it does indicate is that in a constrained investment return environment like the present, there is a strong case to focus on investment strategies targeting the achievement over time of goals defined in terms of returns, investment income or whatever is required and using a flexible approach to do so as opposed to relying solely on set and forget strategies that depend heavily on market based returns.

Source: AMP Capital

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.