Debt Management

Effective debt management is not just about the interest you pay, but also the type of assets you’re investing in and prioritising your debts. There are two basic types of debt ..

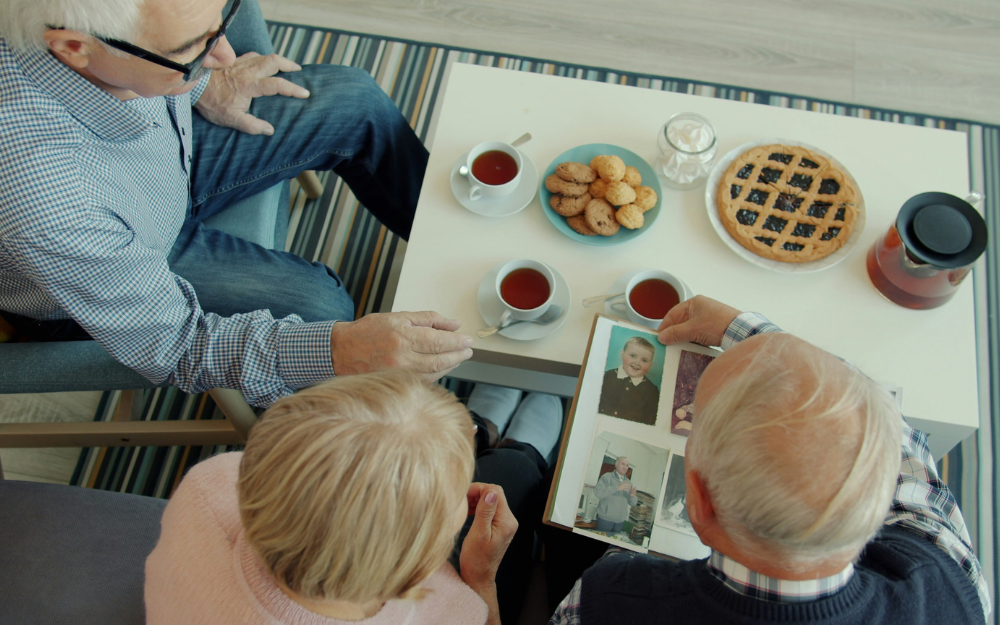

Retirement Planning

Retirement may seem like a long way off but putting money into super now is still a tax effective way to invest your money. You also can benefit from the effects of compounding returns.

Wealth Protection

Insurance is the foundation of all financial plans. ClientComm, Financial Planners can help you evaluate the risks and come up with the right insurance solution for you and your family.

We are passionate about helping businesses and individuals achieve their financial and lifestyle goals. We have been providing professional planning advice since 2009.

Why Choose Us?

Exceptional Personal Service

Our focus is on listening, understanding, and caring about your concerns and providing you with an individual level of service.

Knowledge and Experience

Our Financial Advisers are highly qualified and have a breadth of knowledge and experience necessary to focus on all your important financial matters.

Ongoing Support

Our friendly support team will support you throughout your journey with us and answer any questions you have along the way.

A Holistic Approach

We want to understand exactly what you want to achieve in life and provide you with strategies and techniques to guide you towards your goals.

Keep You On Track

We will stay in contact with you because we want to ensure your financial plan continues to meet your needs and that you stay on track to achieve your goals.

Ease and Convenience

Deal with one company for your superannuation, investment, debt management, insurance and estate planning needs.

Our Team

Michael has been an Adviser in the Financial Services industry since January 1989. His specialty is with full financial plan construction incorporating advice on wealth accumulation, superannuation, personal and business insurance as well as retirement planning.

Michael prides himself on the ability to simplify complex financial situations and provide advice which is simple to understand and comprehensive in nature.