After the election of Donald Trump in November 2016, a surge in global yields triggered a sharp sell-off in global listed infrastructure. Global listed infrastructure fell 4 per cent that month and underperformed global equities by 12 per cent – the second worst monthly relative performance since 2002.

After the election of Donald Trump in November 2016, a surge in global yields triggered a sharp sell-off in global listed infrastructure. Global listed infrastructure fell 4 per cent that month and underperformed global equities by 12 per cent – the second worst monthly relative performance since 2002.

With the threat of further yield rises looming, it’s understandable advisers and their clients would be concerned about the outlook.

Nonetheless, investors shouldn’t give up on this important investment class. There are strong reasons advisers should remain faithful, and focus not on short-term market movements, but on the resilience of global listed infrastructures’ underlying assets and their ability to generate visible and growing cash flows.

Bond proxies

It’s not surprising that global listed infrastructure as an asset class is sensitive to rate rises in the short term.

Infrastructure companies provide owners with stable and reliable streams of cash flow, often paid out as regular dividends. That risk/reward profile is usually compared to those of other lower-risk investments such as fixed income, thus receiving the term ‘bond proxies’ from time to time.

The tools used to value infrastructure assets are rate sensitive, as are regulatory frameworks and contracts that are based on allowed rates of return. Infrastructure assets often have higher leverage, and higher rates can impact financing costs and ultimately cash-flow streams themselves.

Surprising resilience

What is surprising is the asset class’ ability to weather rate rises over time.

November was not the first time in recent history that yields have risen, causing global listed infrastructure to underperform global equities in the short term.

We have seen four distinct periods of sizeable and protracted increases (at least 75 basis points lasting for more than 100 days) in long-term interest rates since the end of the Global Financial Crisis (GFC), which marks the beginning of the current business cycle.

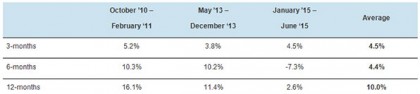

As shown in the table below, each of these periods, including the Taper Tantrum in 2013, exhibited similar dynamics: increasing nominal and real (above inflation) sovereign yields, strong performance of global equities, and relative underperformance of global listed infrastructure.

Table 1. Absolute performance during periods of rising yields

Past performance is not a reliable indicator of future performance.

However, as you can see in the next table, global listed infrastructure recovered all the relative underperformance to global equities in the 12 months following these periods of increases in nominal yields.

Table 2. Relative performance following periods of rising yields – Global Listed Infrastructure vs. Global Equities

Past performance is not a reliable indicator of future performance.

One key reason for the absolute and relative recovery in performance (besides a normalization of interest rates) is the recognition of the asset class’s long-term stability of cash flows.

It is important to differentiate between the short-term volatility of equity prices and the long-term stability of cash flows, which, in our view, explains the strong correlation between the long-term performance of the asset class and its cash flow growth.

Sector diversification

If investors are unconvinced and still concerned, but would like ongoing exposure to global listed infrastructure, an understanding of specific characteristics of regions and sectors within the asset class can help them position investments to mitigate some interest rate risk.

The drivers of cash flows of a communication tower company in Italy are very different from those of an electric utility company in the US, or an airport in Australia; regulatory frameworks and contract structures vary greatly from sector to sector and from region to region.

-

Utilities are perhaps the companies with the highest sensitivity to changes in interest rates, given their long duration, above-average financial leverage, and highly regulated activities with very limited exposure (if any) to economic growth.

-

Communication infrastructure companies also have a relatively long duration and above-average financial leverage, which makes them highly sensitive to changes in interest rates as well. However, exposure to secular growth thematics (such as mobile data traffic) partially offsets the impact of rising rates.

-

Transportation companies generally are the least sensitive to changes in interest rates, given they have the greatest exposure to economic growth. Having said that, interest rates tend to impact the sector in different magnitudes because of the diverse regulatory frameworks of assets, the length of concessions and financial leverage.

-

The Oil & Gas Storage and Transportation sector’s sensitivity to changes in interest rates is also relatively lower. The long duration of the life of the assets and above-average financial leverage are offset by higher exposure to economic growth and, more importantly, region and/or sector-specific growth dynamics, which may be more affected by changes in commodity prices. Given these unique drivers, the sector is also relatively de-correlated from the broader asset class.

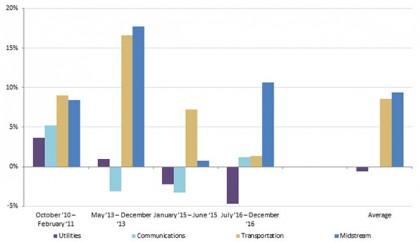

With the different duration, regulatory frameworks and exposure to economic growth, it is not surprising that, as seen in the chart below, global listed infrastructure’s sectors have performed quite differently during those periods of rising sovereign yields.

Performance of Global Listed Infrastructure sectors

Source: AMP Capital, Dow Jones, Bloomberg, December 2016

Past performance is not a reliable indicator of future performance.

An opportunity in underperformance

Income-generating assets play a crucial role in clients’ ability to fund their goals and dreams, particularly retirees and there is no doubt the prospect of future rate rises is creating a challenging period for advisers.

With its strong cash flow characteristics, global listed infrastructure is an important asset class in any adviser’s toolkit.

It would be a shame to panic in the face of short-term relative underperformance and either ignore the asset class completely, or sell out.

Indeed, we believe that the volatility of listed infrastructure equities triggered by short-term increases in interest rates actually presents an opportunity for investment managers like ourselves, as well as advisers, to capitalize on the dislocation of value and price.

By investing in a truly diversified portfolio of companies within global listed infrastructure, we believe that advisers can mitigate a lot of the risk arising from macro factors, such as interest rates.

This article was based on the Global Listed Infrastructure: Not just a bond proxy whitepaper. Click here to read the full paper.

If you would like to discuss anything in this article, please call us on 07 5443 8312.

Source: AMP Capital 12 April 2017

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.