Introduction

This note takes a look at the implications of Australia’s Federal election. The Australian Federal election has delivered a messy result suggesting an even more difficult Senate for the Coalition if it is able to form government and the risk of return to minority government. The risk is that we will see a further slippage in the budget outlook – with a downgrade in Australia’s AAA sovereign rating looking increasingly likely – and that significant economic reform will remain off the agenda. This is dampener for long term economic growth and share market returns. That said, it’s not a disaster as the period of true minority government over 2010-13 saw the economy continue to grow and it’s not unusual for Australian governments to face a difficult Senate.

The messy Federal election result

As with the Brexit vote betting markets and the smart money also got the Australian election wrong, with an ultra close result more in line with what the polls were saying. With a large number of postal votes yet to be counted it may be several days before the result is finally known if individual seats are very close. While there is an argument that postal votes may favour the Coalition, this may not be the case and there is a risk that neither of the major parties will have the necessary 76 seats to form government in their own right and will have to negotiate with independents. This may favour the Coalition but again depends on how the postal votes go and which way the required number of independents lean.

The vote to Leave poses several risks.

After the 21 August 2010 Federal election it took several days for the result to be known and then 17 days of negotiation before a minority Labor led government was appointed on 14 September. Even if the Coalition is able to form government it looks like facing an even more difficult Senate.

Policy implications

If the Coalition is able to form government, the even more difficult Senate will mean that it will have little chance of passing some key aspects of this year’s Federal Budget including its company tax cuts (at least not for large companies), some of its superannuation changes and the still to be passed savings from the 2014 budget. The likelihood would be more slippage in the return to budget surplus, particularly if it has to “pay” for minority government with additional spending to get the support of independents in the House or the Senate. Serious economic reform – including tax reform – would yet again be off the agenda. It would be next to impossible for a Coalition government to get enough votes to reinstate the Australian Building and Construction Commission.

Alternatively, if Labor is able to form government via say a minority government with the Greens and others it will likely mean faster public spending growth via more spending on health and education, partly funded by tax increases on higher income earners (retention of the budget deficit levy and cutbacks in access to negative gearing and the capital gains tax discount and superannuation savings similar to those of the Coalition although all the details haven’t been spelled out) but a higher budget deficit in the next few years, a royal commission into banking and greater intervention in the economy. The influence of left leaning Greens and populist independents could risk seeing an even great slippage in the budget over the forward estimates than Labor Party election policies indicated.

Economic risks

The prospect of another three years of de-facto “minority” government (either in the lower house or with an unfriendly Senate) coming on the back of the minority Gillard/Rudd government over 2010-13 and the 2013-16 Coalition government facing a hostile Senate making it unable to pass much of its economic and budget reform agenda is not a great outcome for the Australian economy.

More broadly, the success of the Labor campaign offering more spending and higher taxes coming on the back of the Brexit outcome in the UK and the success of Trump and Sanders in the US adds to evidence that median voters are shifting to the left and away from the economic rationalist policies of deregulation, smaller government and globalisation.

There are a number of economic implications. Firstly a renewed sense of political and policy instability (minority government, an intractable Senate, a possible early election) may weigh on consumer and business confidence. In terms of the latter this was not such a big deal in overall growth terms for the 2010-13 minority Labor government because mining investment was very strong. It could be more of an issue now as we need to see a pick-up in non-mining investment.

Secondly, serious economic reform to boost productivity growth and keep living standards rising in the fashion we have become used to is likely to remain missing in action. This will be a long term drag on Australia’s growth potential.

Thirdly, there is a danger in relying on tax hikes on the rich (whether retention of the budget levy or cutting access to concessions) in that Australia’s top marginal tax rate of 49% is already high, particularly compared to our neighbours; 33% in NZ; 20% in Singapore; and 15% in HK. Australia’s income tax system is already highly progressive; 1% of taxpayers pay 17% of tax (with an average tax rate of 42%) and the top 10% pay 45% of tax. Longer term this could start to weigh on the incentive to work further reducing Australia’s growth potential.

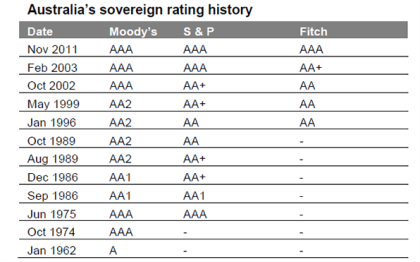

Fourthly, there is now a serious risk that Australia will lose its AAA sovereign credit rating. The perpetual slippage in the return of the budget to surplus over the last 5-6 years or so has been tolerated by the ratings agencies because we had only had a few years of budget deficits and a low starting point for net public debt. But recently they have started to lose a bit of patience. The last time we lost our AAA rating was in September 1986 – see the next table. We are now looking at a much longer and bigger run of budget deficits (as a percentage of GDP), our public debt ratios are worse and our reliance on foreign savings (the twin deficit problem) is little changed.

So as ratings agencies have started to lose patience recently, any further slippage in our return to surplus could tip one or more of them over into putting us on “negative credit watch” ahead of a downgrade. Short term political uncertainty as to “who will form government” is not enough to trigger this but a negative impact of the election on the return to budget surplus would. Unfortunately all the scenarios leading to a new government above point in that direction. So a downgrade would not surprise me.

What would this mean? In theory it should mean higher interest rates as foreigners demand a higher yield on Federal debt and this flows through to state debt, banks, corporates and potentially to out of cycle mortgage rate hikes for households. In reality this impact may be muted. The US in 2011 and the UK last week actually saw bond yields fall after ratings downgrades and many lower rated countries borrow more cheaply than Australia (eg, Italy and Spain). And in any case the RBA can still offset higher interest rates with another interest rate cut.

Rather the biggest impact from a ratings downgrade would be the blow to the national psyche. Australia worked hard reforming the economy after the 1986 downgrade and won a AAA rating back in 2002. Losing it again would signal that we have become unable to control public spending, that we have lost our way to some degree after all the hard work of the Hawke/Keating and Howard/Costello years.

Finally, the negative impact of the messy election result and continued “minority” government adds to the case – along with low inflation, Brexit risks, etc – for another RBA interest rate cut.

Implications for investors

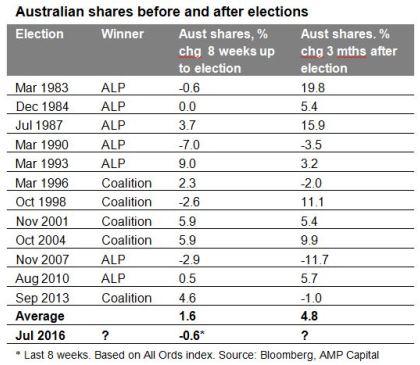

So far the Australian share market has taken the election uncertainty in its stride. But it’s early days. Shares rose an average 4.8% over the 3 months after the last 12 Federal elections with 8 out of 12 seeing gains. Will we see a post-election rally over the next 3 months this time around? Relief at getting the election out of the way may help but the messy outcome and the likely less friendly Senate (at least for a Coalition government), September quarter seasonal weakness in shares and Brexit uncertainty are likely to weigh in the short term even though I still see shares being higher by year end

Longer term the shift to populist policies, budget slippage and the lack of economic reform are dampeners on share gains.

The prospect of “minority” government in one form or another is likely a negative for the $A, particularly if it results in lower interest rates than otherwise and a ratings downgrade. That said I have long seen further downside to around $US0.60 for the $A anyway and there is no reason to change that.

For property the increased uncertainty that may flow from the election is a negative but only a small one and should be offset by any additional lowering in interest rates. The bigger impact will come if Labor forms government and its policy to restrict negative gearing to new property and to halve the capital gains tax discount comes to pass in which case it will be a dampener on long term investor demand for property.

But there is no reason to get too negative

The election outcome is not great. And the widening left/right divide in Australian politics suggests greater policy uncertainty and dwindling prospects for productivity enhancing economic reform, which could be a dampener on growth in living standards. However, there is no reason to get too negative.

Firstly, we have seen “minority” government before – in 2010-13 in the true sense of the word, and for much of our history where the government has not had control of the Senate. And these periods have not normally seen economic disaster.

Secondly, many other countries are facing similar pressures with populist anti-establishment movements and minority governments, so Australia is not alone.

Finally, regardless of the politics the Australian economy does have a degree of resilience. This in part owes to low interest rates and the low $A but also to the reforms of the 1980s and 1990s. So while things could be a lot better it’s not that bad.

Source: AMP Capital

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.